Mapping the New Compliance Landscape

From the SEC’s Marketing Rule to the FCA’s Consumer Duty, MAS technology risk guidelines, and evolving ESG disclosures, the map keeps redrawing itself. A clear inventory helps you spot cross-impacts early and cut duplicate effort across policies, controls, client communications, and reporting cycles.

Mapping the New Compliance Landscape

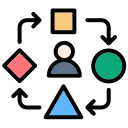

Firms that plan quarterly reviews, scenario test new guidance, and pre-brief business owners reduce costly rework later. Build a simple cadence: scan, triage, design, implement, review. This rhythm turns surprise audits into routine conversations and preserves your team’s focus on client value.