Governance That Sticks Under Pressure

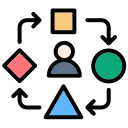

Document senior manager responsibilities, publish clear accountability maps, and have leaders discuss compliance in town halls; visible commitment shapes behavior faster than any memo or poster.

Governance That Sticks Under Pressure

For every obligation, define who is responsible, accountable, consulted, and informed, plus escalation timelines; rehearse them quarterly so surprises become manageable, documented, and quickly resolved.