The Advisor’s Toolkit for Compliance

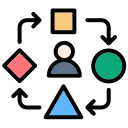

Start with a simple policy map: client onboarding, risk profiling, product comparison, disclosure delivery, and review scheduling. Link each step to a named owner and a timestamp. When procedures reflect real habits, audits become smoother and training becomes faster. Post your biggest procedural pain point and we will workshop solutions.

The Advisor’s Toolkit for Compliance

Document key conversations in plain language: goals, trade-offs, risks discussed, fees emphasized, and options considered. Consistency matters more than perfection. Think of notes as a story that proves care, not bureaucracy. Want a one-page template that catches everything? Subscribe, and we will send a fillable version.

The Advisor’s Toolkit for Compliance

Look for tools that track disclosures, automate reminders, flag inconsistencies, and log approvals. Choose features that integrate with your CRM to reduce duplicate entry. Pilot with a small client group first, learn, then scale. Comment with your favorite tools and why they work in your environment.

The Advisor’s Toolkit for Compliance

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.